30+ Fha loan first time home buyer

The option of a low down payment and more lenient credit requirements can make FHA loans particularly attractive for first-time home buyers although you dont have to be a first-time home buyer in order to qualify. FHA loans are available with fixed or adjustable rates and for 30- or 15-year terms.

Home Loans St Louis Real Estate News

CalHFAs first-time home buyer loan programs.

. Borrowers can roll closing costs into their loans. Only one occupying first-time borrower on each loan transaction. This loan often works well for first-time homebuyers because it allows individuals to finance up to 965 percent of their home loan which helps to keep down payments and closing costs at a minimum.

You can only get a new FHA loan if the home you consider will be your primary residence. The CalHFA FHA program is a first mortgage loan insured by the Federal Housing Administration. FHA loan Insured by the Federal Housing Administration FHA loans allow borrowers to buy a home with a minimum credit score of 580 and as little as 35 percent down or a credit score as low.

Fannie Maes HomeReady mortgage requires a lower down payment than an FHA loan at 3. Use this FHA mortgage calculator to get an estimate. We will use this information to work with you and determine the best options available to you.

For instance the minimum required down payment for an FHA loan is only 35 of the purchase price. Refinancing with an FHA loan has some great benefits too. Down payments can range from 3 to 5 for a conventional loan and start at 35 for an.

For instance while the CalPLUS Conventional Program comes with a slightly higher 30-year fixed rate than the CalPLUS FHA loan. The CalHFA FHA Program is an FHA-insured loan featuring a CalHFA 30 year fixed interest rate first mortgage. About two-thirds 70 percent of first-time buyers say they put less than 20 percent down on their first home and a quarter 24 put down 5 percent or less.

They allow borrowers to finance homes with down payments as low as 35 and are especially popular with first-time homebuyers. The interest rate on the CalHFA FHA is fixed. This program is a 30-year fixed-rate loan.

You can put down as little as 35. About 37 percent of home buyers are purchasing a home for the first time and with that first home can come particular financial hurdles around saving for a down payment and paying for closing costs. An FHA Loan is a mortgage thats insured by the Federal Housing Administration.

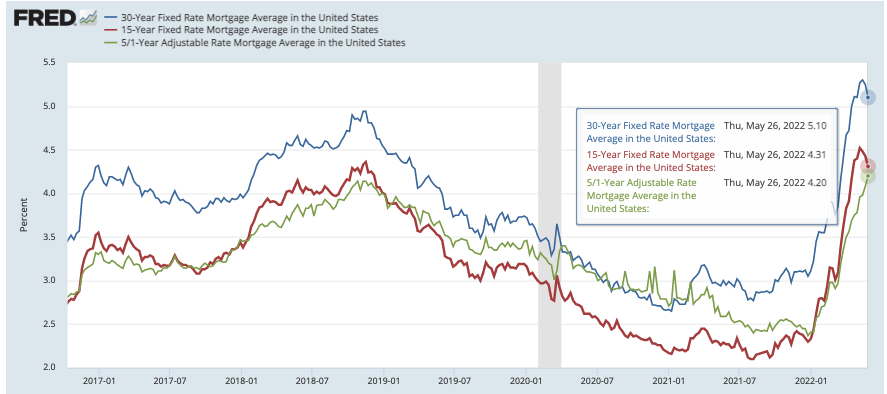

FHA First Time Home Buyer - Apply Online. If youve already got an FHA loan you can refinance with an FHA. 15-year fixed-rate loans are also available via the FHA program.

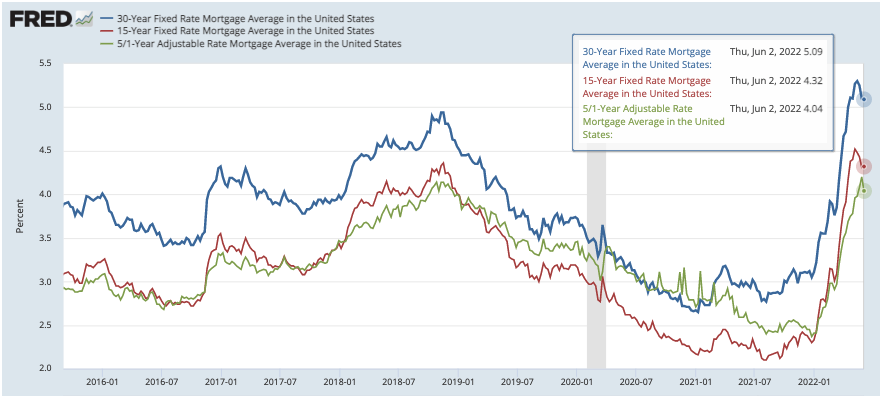

Steps to prequalify as a first-time home buyer. Most home buyers choose a 30-year fixed-rate mortgage which has equal payments over the life of the loan. About 30-60 business days depending on your lender.

So on a 250000 home that would be a 7500 down payment which should be doable for most applicants. An FHA Home Loan Specialist will review your information and respond within one business day. Take advantage of these Texas first-time home buyer programs as well as national home buyer programs.

FHA loans have lower credit and down payment requirements for qualified homebuyers. Hanna Kielar - August 30 2022 There are. An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration.

The 203b home loan is also the only loan in which 100 percent of the closing costs can be a gift from a relative non-profit or government agency. But the same first-time buyer programs should apply. FHA and VA loans for example are great options for current students or recent graduates who want to balance their student loan repayments with a mortgage.

FHA loans are a good option for first-time homebuyers who may not have saved enough for a large down payment. The fixed-rate mortgage was the first mortgage loan that was fully amortized fully paid at the end of the loan precluding successive loans and had fixed interest rates and payments. Here are some benefits of FHA loans.

Fixed-rate mortgages are the most classic form of loan for home and product purchasing in the United States. See if you qualify for these first-time home buyer programs loan options and grants. Note- FHA eligibilty is for US.

Many first-time homebuyers may find the best loan optionssome even offering 100 financingthrough government-backed loan programs like the Federal Housing Administration FHA Department of Veterans Affairs VA. FHA loans have low down payment requirements. The most common terms are 15-year and 30-year.

Amp Pinterest In Action Evaluation Form Employee Evaluation Form Evaluation Employee

Home Buying Tips For Your 20s 30s And 40s Real Estate 101 Trulia Blog

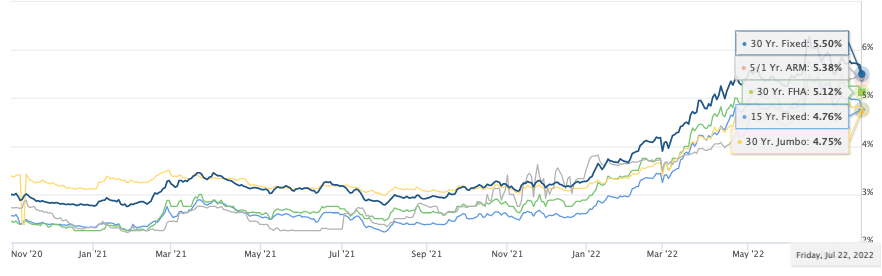

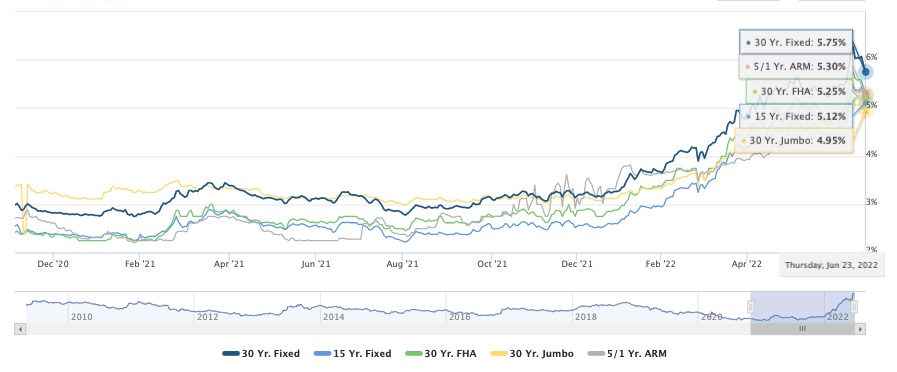

Home Loans St Louis Real Estate News

30 Money Saving Challenges To Start Today Travel Savings Plan Saving Money Budget Money Saving Challenge

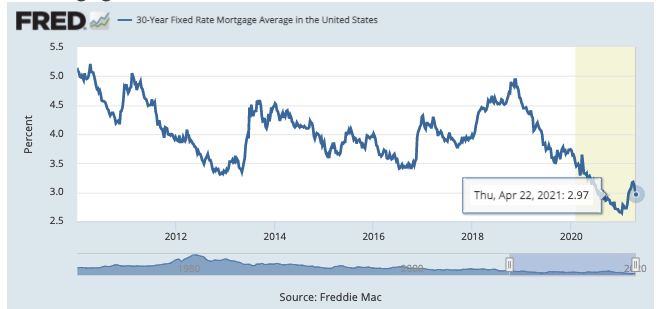

30 Year Fixed Mortgage Arthur Hahn Mortgage Loan Originator

David K Wang Realtor

30 Examples On How To Thank Your Mortgage Lender

30 Year Fixed Mortgage Archives Latisha M Elliott Loan Officer

Home Loans St Louis Real Estate News

11 Real Ways To Increase Your Income In 30 Days Or Less

Home Loans St Louis Real Estate News

Home Loans St Louis Real Estate News

Home Loans St Louis Real Estate News

Citizens Bank Mortgage Rates 5 43 Review Details Origination Data

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

Home Loans St Louis Real Estate News

Residential Msr Market Update September 2019 Miac Analytics